This story was originally published by Chalkbeat. Sign up for their newsletters at ckbe.at/newsletters

Sign up for our free monthly newsletter Beyond High School to get the latest news about college and career paths for Colorado’s high school grads.

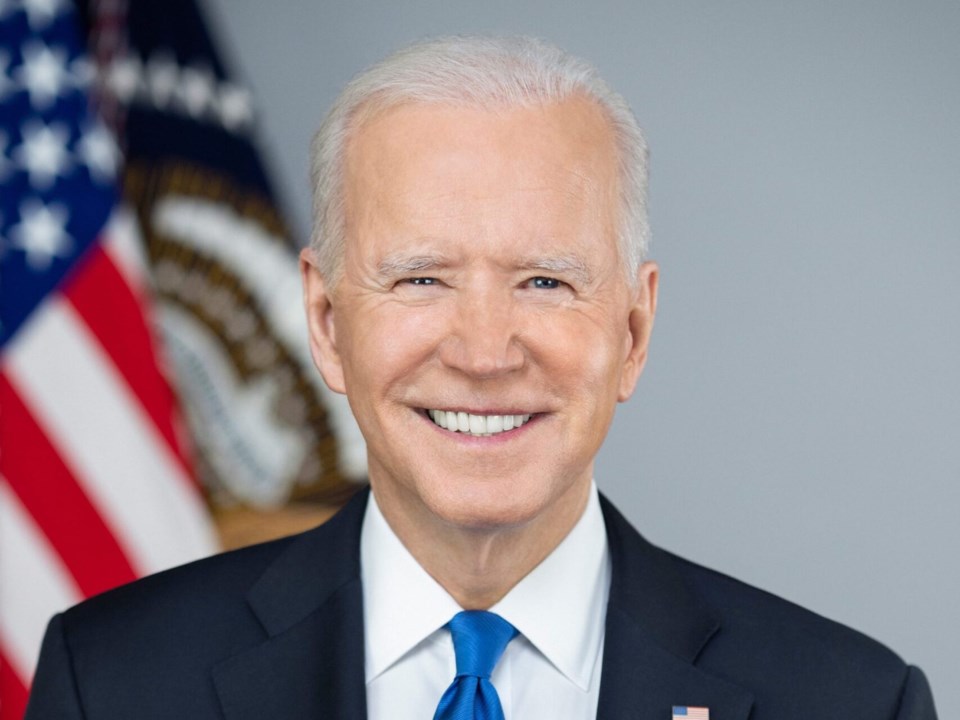

President Joe Biden’s first attempt to provide widespread relief from student loan debt failed, but now you may have another shot.

Five different types of borrowers would get relief under a new debt relief plan announced Monday by the Biden administration. The White House estimates over 30 million student loan debt holders nationwide would be eligible for debt relief under the plan that’s been in the works since the fall.

The new plan announced on Monday follows less than a year after the U.S. Supreme Court nullified a previous Biden plan to cancel up to $10,000 for most borrowers.

Over 43 million Americans hold over $1.6 trillion in federally backed student loan debt. Late last year, after the Supreme Court decision, those Americans restarted payments that had been on hold since near the start of the pandemic.

The cancellation of student loan debt has been a big goal of the Biden administration, although like its first push to cancel student debt, advocates and the administration expect pushback and legal challenges to the new plan.

Here’s what you should know about Biden’s newest student debt relief plan:

Am I eligible for relief under Biden’s plan?

Compared to the Biden administration’s first attempt for broad cancellation of debt, this new plan would provide more targeted relief. Here’s who would qualify:

People who owe more money than originally borrowed: First, the plan would potentially help over 25 million people who owe more money than they originally borrowed. Many have made years of payments. The Biden administration expects about 23 million would get relief on their unpaid interest.

The new plan would cancel up to $20,000 of unpaid interest on eligible borrowers’ loans, regardless of income. Low- and middle-income borrowers who have enrolled in the Saving on a Valuable Education or an Income Driven Repayment plan would be eligible to get all of their unpaid interest forgiven since they began paying on their loans.

The federal government said this type of forgiveness would be automatic.

Borrowers who are currently eligible for loan forgiveness programs but have not enrolled: The plan would also give debt relief for borrowers eligible for loan forgiveness programs but who are not enrolled. The U.S. Department of Education said too many borrowers “have historically not been able to overcome paperwork requirements, bad advice, or other obstacles.”

Long-time borrowers: The plan would provide relief for people who have been paying their student loans for more than 20 years by waiving undergraduate school debt for those borrowers. The plan would also forgive graduate school debt for people who have held that debt for 25 years or more.

Students who left college but got little from their degree: The Biden administration wants to also help people who left colleges that either lost the ability to get federal funds or cheated students. Those students left college with what the education department called in a news release “mountains of debt” but few job prospects. The administration has proposed to waive loans for them, as well as students who attended institutions that closed and didn’t provide value.

Borrowers experiencing financial hardship: Lastly, the Biden plan would cancel student debt for borrowers experiencing hardship that’s prevented them from paying back their loans, such as as a child care or medical expense. For this category, the administration is exploring automatic debt forgiveness or an application process.

Do I need to do anything to get relief?

The short answer is: not yet.

As of right now, the plan hasn’t received final approval. The education department will first allow for public comment and review of the new plan, which is expected to take about 30 days. There’s no firm date on when the plan would take effect.

Borrowers should continue to pay off their loans. But they can prepare themselves by familiarizing themselves with the status of their loans on studentaid.gov, and by paying attention to communication from their servicers about any changes.

What’s the White House already done on debt?

The Biden administration stressed it’s already provided extensive relief to people across the country.

Significantly, about 2.5 million people who have long-term student loans have gotten their debt canceled, according to the education department.

In states such as Colorado, that amounts to over 43,000 residents who have recieved about $2.3 billion in debt relief. Across the country, other examples include 53,000 Indiana borrowers, 50,000 Tennessee borrowers, and 157,000 New York borrowers who have had their loans canceled, according to the education department.

What are responses to the new debt relief plan?

The plan wouldn’t impact all borrowers, but the new Biden plan is a big step forward in providing relief to borrowers struggling to pay off interest, according to advocacy group Young Invincibles, which works with young people to elevate their voice on topics important to them.

“Forgiveness for accrued interest is a massive step forward,” said Emmett Blaney, a Young Invincibles policy coordinator for the Rocky Mountain region. “I think that there are folks out there who have been paying down who have not even touched their principal and they’ve been paying really diligently on their student loans trying to pay them back. The interest rates are just an insurmountable barrier.”

Colorado advocacy groups in favor of student debt relief also celebrated the plan.

“By turning debt relief into a reality, young people can soon spend more of their income on necessities like groceries and rent—ultimately making it easier for young people to build lives in communities across the state,“ said Natasha Berwick, political director at New Era Colorado in a statement.

Jason Gonzales is a reporter covering higher education and the Colorado legislature. Chalkbeat Colorado partners with Open Campus on higher education coverage. Contact Jason at [email protected].

Chalkbeat is a nonprofit news site covering educational change in public schools.