Longmont Leader received this column from Kyle Snyder concerning local real estate:

As we transition into the promise of delightful spring weather, it's an opportune moment to peek behind the curtain at the local real estate scene's first-quarter performance. Typically, real estate activity in the initial quarter of the year resembles the anticipation of a frigid February snowstorm, and this year was no exception.

When examining the results for all of Northern Colorado in the first quarter, they can be broadly categorized into two distinct trends. Firstly, there's a notable increase in sales volume accompanied by a slight softening in prices. Conversely, the second trend highlights fewer monthly and/or YTD sales coupled with mildly higher prices. Most of the Northern Front Range falls into the latter category with three notable exceptions: Boulder, Lafayette, and Superior single-family sales.

It's important to bear in mind that markets are gradually emerging from their winter hibernation, influenced by the chilling effect of the highest interest rates witnessed in decades. Thus, it's wise to evaluate first-quarter results with a broad approach, focusing on the quarter as a whole and tempering our expectations on individual months within it. This approach recognizes the inherent volatility in monthly results, particularly in Colorado, where we are smart enough not to move in the winter whenever feasible.

Longmont Area Real Estate Stats March 2024

Boulder Area Real Estate Stats March 2024

Northern Colorado Real Estate March 2024

In most cases, the widespread slight dip in monthly sales for March is offset by the Year-to-Date (YTD) total closings for Louisville, Erie, Longmont, and the Carbon Valley. The results may seem a bit lukewarm, but we had some of the all-time fewest closed sales of single-family homes in the first quarter of 2023 despite interest rates being mostly lower than now. The difference is that those rates were on the rise. Toda, they're on a downward trajectory which will eventually spark buyer enthusiasm. It’s much easier to sell the “date the rate” strategy when rates are going down, compared to when they are climbing.

Similar volume activity can be observed in Loveland, Ft Collins, Greeley, and Windsor too. In fact, all of these areas have slightly improved pricing as well. Given the context our recent 8%+ interest rates, these results are nothing short of remarkable. Markets didn’t completely freeze up, which is a tremendous relief. I suspect those markets with softer pricing results are just a temporary laggard. Two of them, Boulder and Lafayette typically show the most steady and solid results. The grass is starting to turn green and that usually signifies the start of the selling season.

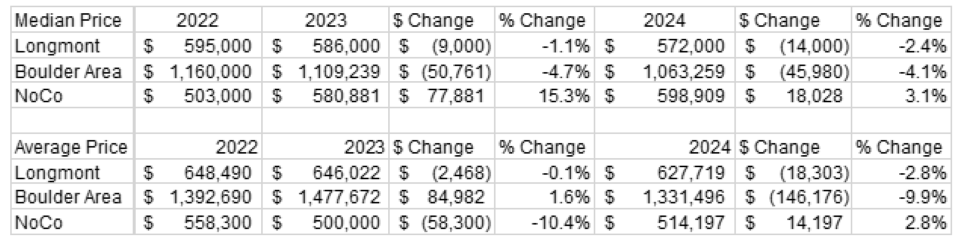

Below, you'll find a bonus chart showcasing the average and median prices for Longmont, Boulder, and NoCo. The areas correspond with the same geographical areas featured in the charts of each of the regional reports linked in this report. The Fort Collins, Loveland, and Greeley combined market median price was the only one that grew in the first-quarter in both 2023 and 2024. Notice that the dollar amounts associated with the percentages aren’t that great. Over two years they net out to a small dollar amount, except for Boulder, but even as a percentage these results are much better than what a lot of experts were predicting.

Parting thought: As buyers show optimism on interest rates in the future, so do homebuilders. A recent report shows “Homebuilder Sentiment” has increased four months in a row. Another shows they are starting to build more homes. These companies must be optimistic in the direction of interest rates if they are out there making billion-dollar bets on their future. Something tells me we'll be discussing entirely different topics come August.

The Longmont Leader accepts contributions, photos, letters to the editor, or LTEs, and op-eds for publication from community members, business leaders and public officials on local topics. Publication will be at the discretion of the editor and published opinions do not represent the views of the Longmont Leader or its staff. To submit a contribution, email [email protected].