This content was originally published by the Longmont Observer and is licensed under a Creative Commons license.

Similar to other communities in Colorado, Longmont suffers from a lack of affordable housing. As more people move into the area and the stock of housing is limited, this raises the price for housing. High housing costs can be extremely difficult for many residents who earn less than the area’s median income (AMI). The city uses federal, state, and local funds to address the issue and a set of bills recently signed by the governor will help.

A broad group of legislators and relevant stakeholders introduced a package of affordable housing bills in the legislative session that just ended in May. Three of the four bills passed on a bipartisan basis. The three bills expanded the pool of state funds available for affordable housing as well as introduce some innovative methods to address the issue. A summary of these bills is provided below.

HB19-1228 Increase Tax Credit Allocation Affordable Housing: this bill increased the amount of tax credits for developers from $5 million to $10 million annually starting in 2020 through 2024. The tax credits are used by developers to reduce the costs of building housing in exchange for offering units at rates lower than what is typical in the area.

HB19-1319 Incentives Developers Facilitate Affordable Housing: in addition to empowering the relevant tax authority to revoke a property tax exemption on properties that no longer qualify for the exemption, this bill requires all state agencies and state institutions of higher education to submit a list of nondeveloped real property, to update that list as needed, and to make that list available to the public. The bill defines “nondeveloped real property” to be unimproved real property that is not otherwise protected for or dedicated to another use such as needed for access or conservation.

HB19-1322 Expand Supply Affordable Housing: assuming certain state fiscal conditions are met, starting in the 2020 fiscal year through 2023, $30 million will be transferred from the unclaimed property trust fund into a new “housing development grant fund.” Monies from the fund can be used to renovate existing housing, develop utility infrastructure, or purchase new lands for the purposes of building affordable housing. The bill also expands the categories of residents who can quality for rental assistance programs to include homeless families, medicaid clients in nursing homes, family unification and related circumstances, homeless or disabled veterans, low-income households with an annual income at or below 60% of the AMI, and survivors of domestic violence.

What does all of this mean for Longmont? We asked Kathy Felder of the Longmont Housing and Community Investment Division which bills will have the most impact on Longmont.

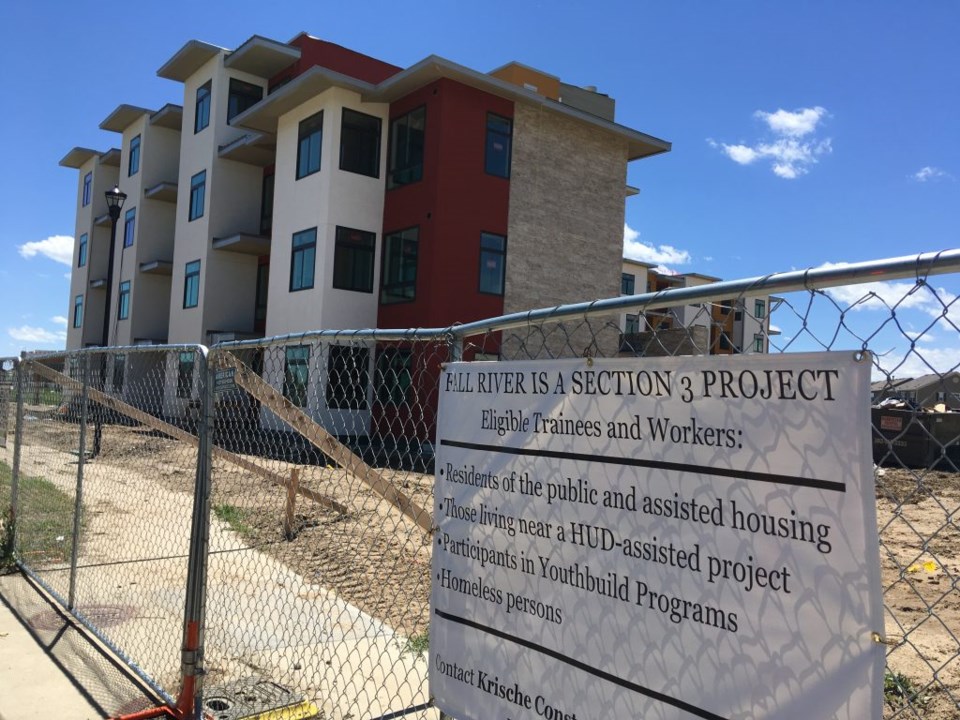

“The bill that increases the state tax credit will have the most impact,” said Fedler. “It's a program that's already established, that our developers are already accessing, and people understand it,” she added. Fedler cited the Fall River apartment project (pictured above), located near 21st avenue and Alpine Ave, as the type of project that has received state tax credit to encourage affordable housing. Construction is due to be completed in late summer 2019. An affordable housing project of 73 rental units at 6th and Coffman is an example of a future project that is more likely to move forward due to the expanded tax credits.

Beyond the increased funding for established housing programs, Fedler was “impressed that there was a commitment [by the legislature] to consider even the smallest efforts or options, like changing the vendor fees. Who thought of that? Great idea, you know.”

The change in vendor fees is related to HB19-1245, Affordable Housing Act of 2019, which changes how retail vendors are compensated for collecting the state sales tax.

“By changing the amount that retailers can claim from a simple cap to a percentage of revenue, the state will recapture that revenue,” Fedler explained.

This change in vendor credit is expected to increase state revenues by about $23 million in the next fiscal year, $7 million of which will go to affordable housing, and then starting in 2021, revenues will increase to about $49 million, 98% of which will go to the affordable housing fund.

The bill also required that one-third of the money in the fund go to households whose annual income is less than or equal to 30% of the AMI. Fedler pointed out that is critical as, “there's not many projects that are accessible to those lower incomes, which is so greatly needed. And it's going to be the only way we're ever going to address the homelessness situation, because folks coming out of homelessness can’t afford a rental unit that is priced at 60% of the AMI.”

Looking forward, there is still much work to be done to create more equity in the housing market in Longmont and elsewhere in the state. “I think we are doing a really good job of prioritizing lower income housing, we just need to keep at it and not lose sight of that,” Fedler said.

More information about affordable housing in Longmont can be found on the city’s Housing and Community Investment page.

.jpg;w=120;h=80;mode=crop)