This content was originally published by the Longmont Observer and is licensed under a Creative Commons license.

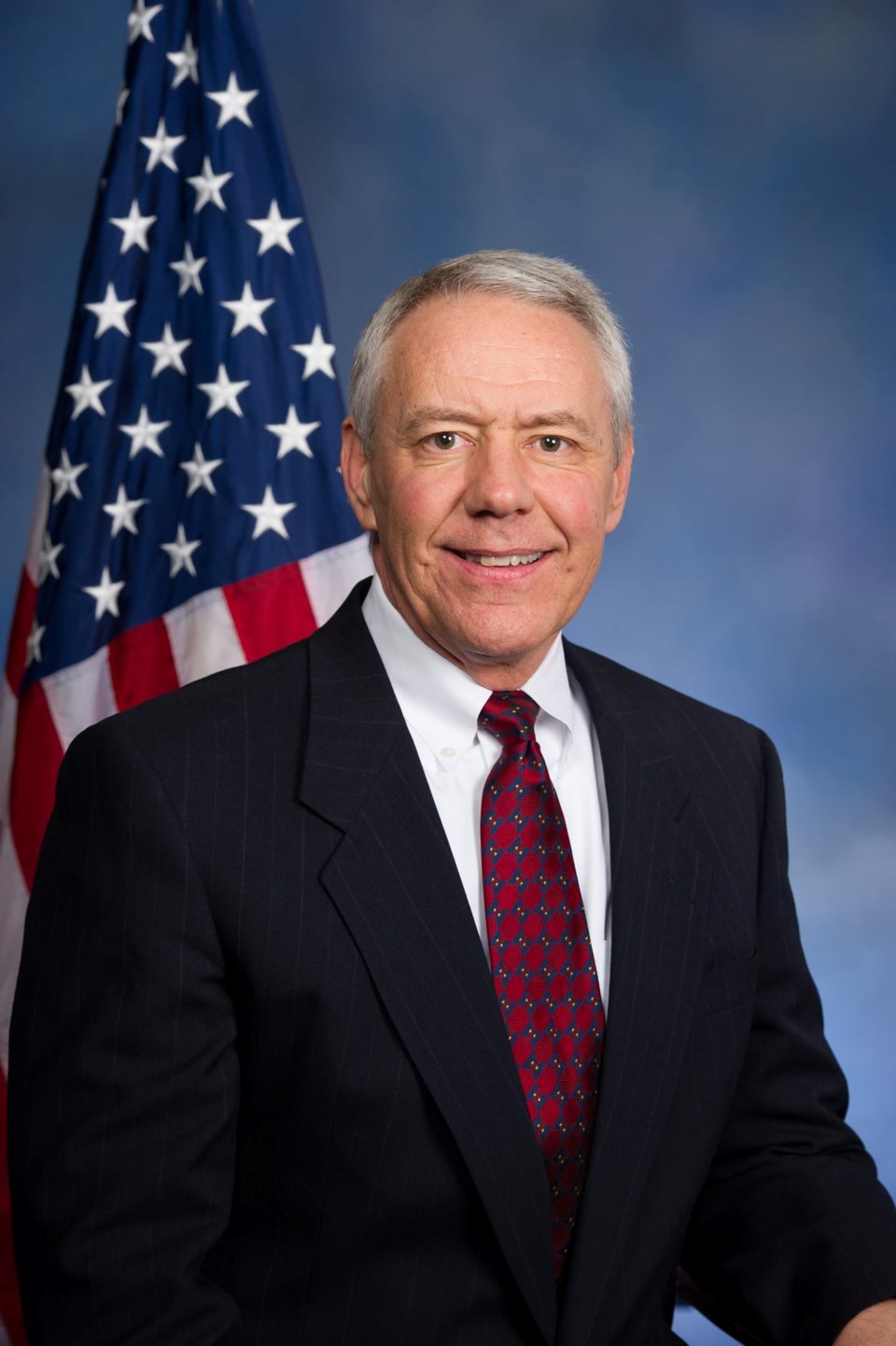

The following is a news release issued by U.S. Congressman Ken Buck to the Longmont Observer. U.S. Congressman Ken Buck represents Colorado’s 4th Congressional district, which includes Longmont, CO. As a non-profit news and media entity, the Longmont Observer neither supports nor endorses political candidates.

Washington, D.C. – Today, Congressman Ken Buck led a bipartisan letter, signed by 31 of his colleagues, requesting that Attorney General Jeff Sessions examine possible antitrust violations occurring in the U.S. aluminum market. Presently, end users of aluminum pay a price set in part by the Midwest Transactional Premium, or MWTP, used to factor in the storage and transportation costs of the final product. But consumers of aluminum are increasingly concerned that Platts, the rating service in charge of setting the MWTP, has deviated from its standard practice of using spot transactions to set the price and is instead working with a few producers, merchants, traders, and banks to set a potentially artificial price.

“When monopolies manipulate aluminum prices, normal Americans suffer from higher prices for the products they buy,” Congressman Ken Buck stated. “I encourage the Attorney General to ensure a fair and transparent process for the pricing of aluminum in this country.”

Aluminum prices impact end-users of aluminum and the consumers who purchase products like soft drinks and beer. When supply prices are artificially inflated, suppliers are enriched and consumers face a higher cost for products.

The text of the letter is below. A PDF of the letter can be found here.

The Honorable Jeff Sessions

Attorney General

U.S. Department of Justice

Dear Attorney General Sessions:

We are writing to urge you to examine the issue of possible irregularities in the aluminum market which appear to have inappropriately inflated the price of aluminum and whether these irregularities raise antitrust concerns. These price increases impact the American consumer at the rate of hundreds of millions of dollars every year in the form of higher prices for the dozens of goods made with aluminum.

We understand that purchasers of aluminum are encountering serious pricing irregularities and potential anti-competitive conduct by aluminum producers, merchants, traders, banks and others which we feel warrant investigation by the Department of Justice. These pricing irregularities for aluminum appear to stem from the “Midwestern Transactional Premium” (MWTP). The MWTP reference price is charged to all end users of aluminum in the United States, and is intended to account for the cost of storage and transportation of aluminum to end users.

The MWTP has recently undergone sharp price increases, despite the fact that logistical costs of sourcing metal from around the world have not moved significantly. Most recently, from November 28, 2017 to March 2018, with the announcement of the 10% tariff on imported aluminum by the Trump administration, the MWTP more than doubled to over 20 cents per pound.

The MWTP is set by the ratings service S&P Global Platts. We are concerned that S&P Global Platts’ pricing methodologies used to set the price of the MWTP for the entire U.S. market may be flawed and not consistently followed. S&P Global Platts claims that its “MW US Transactional Premium” reference price is a transactional premium using actual spot transactions between consumers and suppliers to set the reference MWTP price, but its critics claim that S&P Global Platts does not follow this process consistently. Instead, end users believe that S&P Global Platts at times sets the MWTP price likely in cooperation with select aluminum producers, merchants, traders and banks in order to artificially inflate the MWTP price, keeping their monopoly on setting this reference price.

We believe that these allegations of potential market distortions merit careful examination by the Justice Department’s Antitrust Division.

In summary, despite record stockpiles of aluminum supply in the U.S., the price of aluminum has spiked and fluctuated in ways that indicate market distortions caused by the pricing mechanism of the MWTP. While the MWTP was intended to simply measure the base costs of storing and shipping aluminum, we are concerned that the price point is now being used as an instrument to artificially inflate prices, thereby enriching only specific producers, traders, and other market participants. Bearing the brunt of these higher prices are the end-users of aluminum and those consumers who purchase products like soft drinks and beer. We urge the Department of Justice, specifically your Antitrust Division, to closely examine these issues and whether anticompetitive practices are occurring in the aluminum market.

Thank you for your attention to this matter.

###

.jpg;w=120;h=80;mode=crop)