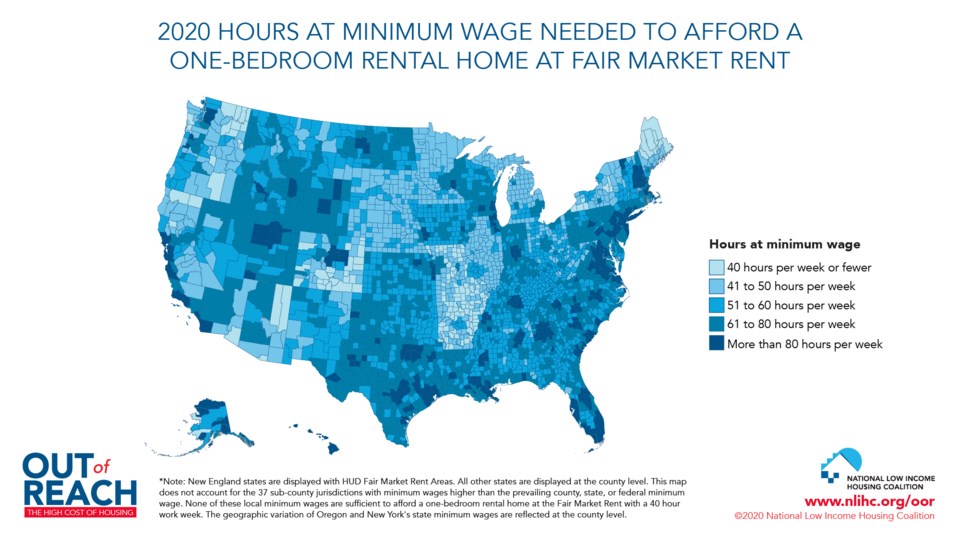

Minimum wage workers in Colorado, including in Longmont, must work more than 80 hours a week to be able to afford a fair market rate two-bedroom apartment, according to a new report from the nonprofit National Low Income Housing Coalition.

Out of Reach 2020: The High Cost of Housing, released Tuesday, “highlights the mismatch between the wages people earn and the price of decent rental housing in every state, metropolitan area, and county in the U.S.,” according to NLIHC. The report calculates the “housing wage” a full-time worker must earn to afford a rental home without spending more than 30% of income on housing costs.

This year’s Colorado housing wage is $26.45 per hour for a two-bedroom home at fair market rent, according to the report; in Boulder County it comes in at $33.02. For a one-bedroom at fair market rate, the statewide housing wage is $21.21 and in Boulder County it is $27.15, per the report.

The state’s minimum wage is $12 an hour, a mark it just reached in January.

In Longmont, the NLIHC reports the housing wage is $26.35 for a two-bedroom unit in the 80501 ZIP code, which is comprised of the heart of the city; in the 80503 and 80504 ZIP codes to the west and east, respectively, it climbs to $30.38.

In Longmont, about 37% of housing units were renter-occupied from 2010-2018, according to the U.S. Census Bureau.

Across Colorado, occupations with wages below those two-bedroom thresholds include laborers; retail employees; and service industry positions, such as waiter, fast-food worker and restaurant cook; but also include clerical positions, such as administrative assistant and customer service associate; bookkeeper; heavy equipment operator; truck driver and elementary school teacher, according to the report.

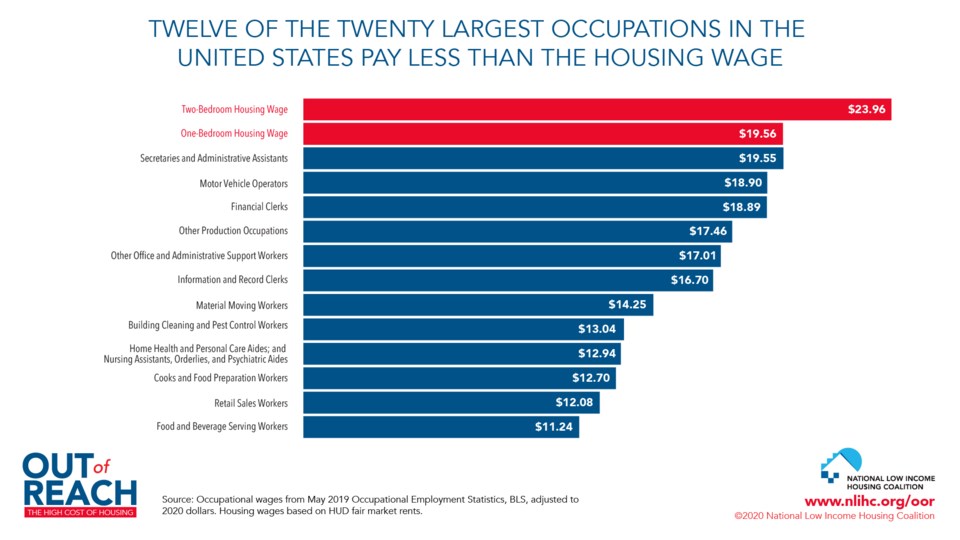

This year’s national housing wage is $23.96 per hour for a two-bedroom home at fair market rent and $19.56 per hour for a modest one-bedroom rental home, according to the report.

Nationwide, 12 of the 20 largest occupations pay less than the two-bedroom housing wage, according to NLIHC.

(National Low Income Housing Coalition)

(National Low Income Housing Coalition)

The report also found that people of color disproportionately face greater challenges in accessing affordable homes.

“Black and Latino workers earn less than white workers, and Black and Latino households are more likely to spend more than 30% of their incomes on housing: While 26% of white households are housing cost-burdened, 42% of Latino households and 44% of Black households are cost-burdened,” NLIHC stated in the news release.

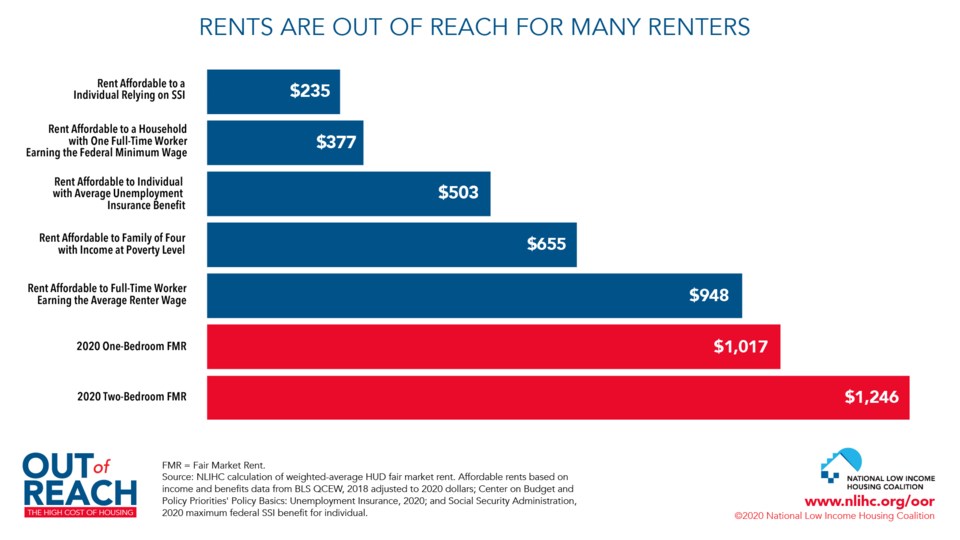

The nonprofit anticipates the coronavirus pandemic will only exacerbate the struggles of lower-wage earners to find housing. “With unemployment rates and reduced wages rising dramatically during the pandemic, evictions and homelessness will also surge, unless significant federal emergency rental assistance and other renter protections are provided,” it stated in the release.

Locally, nonprofits such as the OUR Center and Homeless Outreach Providing Encouragement, or HOPE, have reported that COVID is delivering a staggering blow to low-income families, young adults and the homeless.

NLIHC is calling for Congress to provide at least $100 billion in national emergency rental assistance; a uniform, national moratorium on evictions and foreclosures; $11.5 billion to protect people experiencing homelessness; and additional resources for public housing authorities and housing providers.

“Housing is a basic human need, but millions of people in America cannot afford a safe, stable home,” NLIHC President and CEO Diane Yentel stated in the release. “The harm of this enduring challenge is laid bare during the COVID-19 pandemic, when millions of people in America risk losing their homes. The lack of affordable homes for the lowest-income people is one of our country’s most urgent and solvable challenges, during and after COVID-19; we lack only the political will to fund the solutions at the scale necessary. It’s time for Congress to act.”

In Colorado, a moratorium on evictions expired last month, but on Sunday Gov. Jared Polis extended an order requiring landlords to give 30 days notice to tenants before starting the eviction process.

In Longmont, the city has posted to its website resources to help those facing housing concerns in the midst of the pandemic, including the Boulder County Housing Help Line at 303-441-1206 and guidance from the Boulder County District Attorney’s Office on questions frequently asked by tenants and landlords.

The posting urges tenants to not just stop paying but to work with their landlords on a payment schedule to bring them current again, and landlords to work with tenants. It also lists contacts for mediation including Longmont Mediation Services at 303-774-4384 and Boulder County Legal Services at 303-449-7575.

(National Low Income Housing Coalition)

(National Low Income Housing Coalition)